nh food sales tax

Food prepared on the premises as defined in Rev 70116 which could reasonably be perceived as competing with an eating establishment. A calculator to quickly and easily determine the tip sales tax and other details for a bill.

The Shutdown Of Businesses Across The Country Is Casting A Pall Over A Segment Of The 3 9 Trillion Municipal Bond Market Th Sales Tax Filing Taxes Bond Market

Any New Hampshire business contacted by a state or locality regarding the collection of sales or use tax is also encouraged to contact the DOJs Consumer Protection Bureau.

. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. Tax Rate Starting Price. While many other states allow counties and other localities to collect a local option sales tax New Hampshire does not permit local sales taxes to be collected.

The Nashua Sales Tax is collected by the merchant on all qualifying sales made within Nashua. Consumer Protection Bureau Office of the Attorney General 33. New Hampshire Department of Revenue Administration Governor Hugh.

The tax is collected by hotels restaurants caterers and other businesses. New Hampshire is one of the few states with no statewide sales tax. If you need any assistance please contact us at 1-800-870-0285.

Designed for mobile and desktop clients. NH Department of Revenue Reminds Taxpayers of Meals and Rooms Tax Rate Reduction. 2022 New Hampshire state sales tax.

A 9 tax is also assessed on motor vehicle rentals. Please note that the sample list below is for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction shown. 53 rows a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda.

While many other states allow counties and other localities to collect a local option sales tax New Hampshire does not permit local sales taxes to be collected. There are however several specific taxes levied on particular services or products. LicenseSuite is the fastest and easiest way to get your New Hampshire meals tax restaurant tax.

Please note that the sample list below is for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction shown. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85 For additional assistance please call the Department of Revenue Administration at. Exact tax amount may vary for different items.

A sales tax of 9 exists on prepared meals in restaurants short-term room rentals and car rentals. They send the money to the state. If you need any assistance please contact us at 1-800-870-0285.

603 230-5945 Contact the Webmaster. B Three states levy mandatory statewide local add-on sales taxes. Use this app to split bills when dining with friends or to verify costs of an individual purchase.

New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Starting on October 1 2021 the meals and rooms tax rate was decreased from 9 to 85.

State of Alaska. New Hampshire. New Hampshire is one of the few states with no statewide sales tax.

LicenseSuite is the fastest and easiest way to get your New Hampshire foodbeverage tax. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055 cents per megawatt-hour on electricity and a 7 tax on telecommunications services. A bit of that money goes toward school building loans and tourism promotion.

A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more. State State General Sales Tax Grocery Treatment. 1-888-468-4454 or 603 271-3641.

California 1 Utah 125 and Virginia 1. New hampshire does not exempt any types of purchase from the state sales tax. The Sales Tax Institute mailing list provides updates on the latest news tips.

We include these in their state sales tax. Last updated November 27 2020. A 9 tax is also assessed on motor vehicle rentals.

The Nashua New Hampshire sales tax is NA the same as the New Hampshire state sales tax. New Hampshire Department of Revenue Administration Governor Hugh Gallen State Office Park 109 Pleasant Street Medical Surgical Building Concord NH 603 230-5000 TDD Access Relay NH. The table below summarizes sales tax rates for new hampshire and neighboring states in 2017 as well as the states policy with respect to types of items commonly exempted from sales tax ie food prescription drugs and nonprescription drugs.

1 those in New Hampshire eating at restaurants and food service establishments purchasing alcohol at bars staying at hotels and app-driven accommodations on Airbnb or Vrbo or renting. State Sales Tax Rates and Food Drug Exemptions Page 1. The Portsmouth New Hampshire sales tax is NA the same as the New Hampshire state sales tax.

Join 16000 sales tax pros who get weekly sales tax tips. New Hampshire Guidance on Food Taxability Released. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

New Hampshire NH sales tax is currently 0. Does Nh Tax Food. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. The state sales tax rate in New Hampshire is 0 but you can customize this table as needed to reflect your applicable local sales tax rate. Starting October 1 the tax rate for the Meals and Rooms Rentals Tax will decrease from 9 to 85.

Technical Information Release TIR 2007-005 New Hampshire Department of Revenue Administration August 7 2007 Posted on August 22 2007.

Where Your State Gets Its Money State Tax States Charts And Graphs

How Do State And Local Sales Taxes Work Tax Policy Center

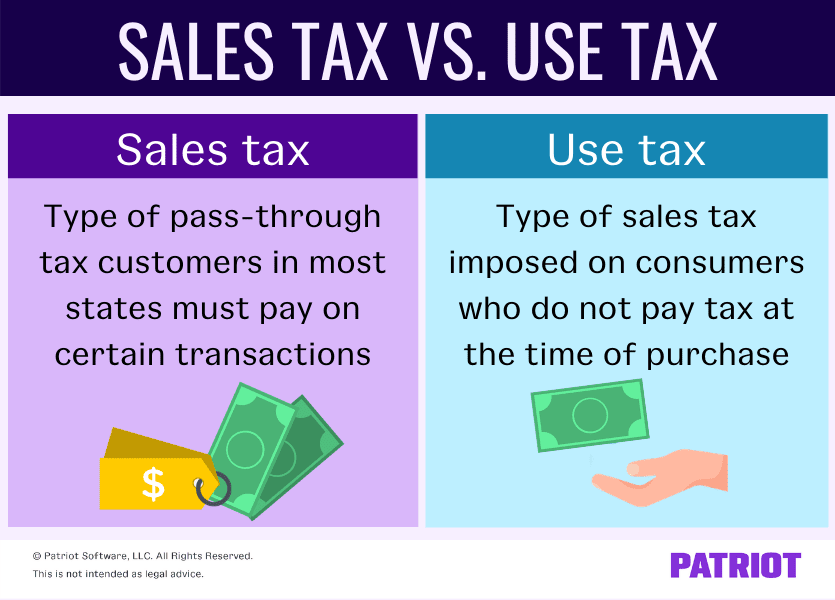

Sales Tax Vs Use Tax How They Work Who Pays More

.png)

States Sales Taxes On Software Tax Foundation

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Pin By Cindy Brown On Fish In 2022

State Sales Tax Rates And Combined Average City And County Rates Download Table

Sales Tax On Grocery Items Taxjar

South Dakota Sales Tax Small Business Guide Truic

These Are The U S States That Tax Women For Having Periods Tampon Tax Pink Tax Tampons

Http Www Nolo Com Legal Encyclopedia 50 State Guide Internet Sales Tax Laws Html Kansas Missouri New Hampshire Nebraska

How To Charge Your Customers The Correct Sales Tax Rates

When Did Your State Adopt Its Sales Tax Tax Foundation

Pin By Santainc On Amazing Infographics Infographic Bits And Bobs New Hampshire

Do You Know About Your State S Use Tax If It S Got A Sales Tax It Has One And You Re Supposed To Pay It American History Timeline Accounting Services Tax

States With Highest And Lowest Sales Tax Rates

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation